The EU is getting worried about the high energy prices paid by European companies. Well, maybe they should have thought of that earlier.

Another EU summit was held last week, where energy issues were discussed (among other topics). However, the issue of tax avoidance and tax fraud seems to have stolen the media spotlight, and there wasn’t much time to deal with energy. A pity, since there would be have been much to talk about, but there’s always some more pressing issue at hand.

The summit’s closing document repeats the standard EU energy narrative: yes, the single energy market will be completed by 2014 (no, it won’t), supply security and source diversification are crucial, a lot of market investment is needed, bla bla bla.

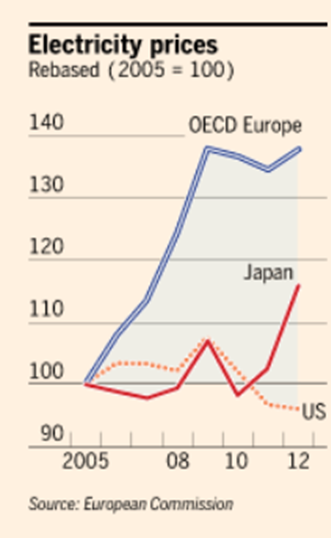

According to the Financial Times, the energy debate probably revolved around the following chart. This shows that electricity costs for European companies have increased substantially since 2005, while they stagnated in the US and rose much slower in Japan.

The electricity chart dominating the debate. Source: Financial Times

The electricity chart dominating the debate. Source: Financial Times

It’s no surprise that the issue of energy costs is on the agenda, and that the discussion isn’t instead focusing on how to avoid the global climate catastrophe drawing nearer and nearer. The Eurozone has been mired in recession for a long time, unemployment figures reach record highs every month, and there seems to be no light at the end of the tunnel for Europe’s economic woes.

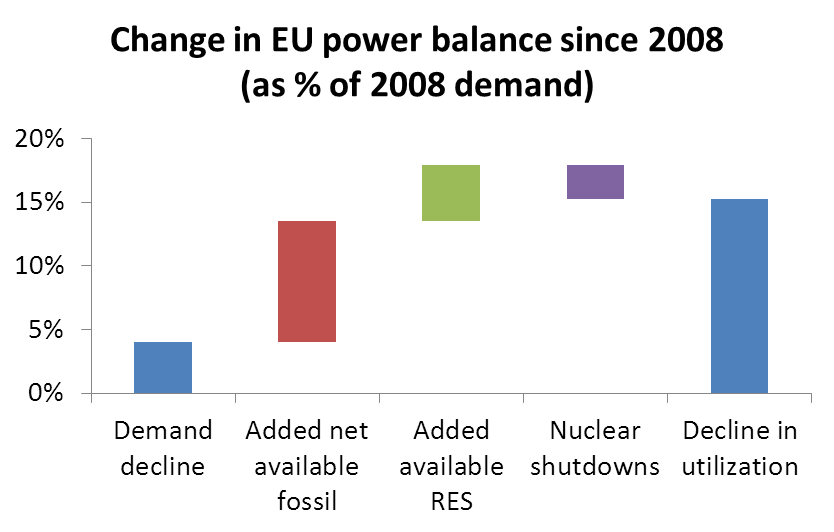

The question remains then: Why are electricity costs so high in Europe? Because evil energy producers are swindling consumers? Not exactly. There are massive overcapacities in the EU electricity market at the moment. EU electricity demand has fallen by 4% compared to pre-crisis levels, while power plant capacity has grown significantly (despite the halting of German nuclear power stations). This DEPRESSED the wholesale market price of electricity. For example, in 2006 (before the crisis) 1 MWh of baseload power (the price of non-stop 24-hour supply) cost €50 in Germany, while it’s currently just above €30, with next year’s forward price at around €40. Just to make the point clear: this means that end-consumer electricity prices did NOT rise because of high fossil fuel costs.

Demand has fallen, supply has increased in the EU electricity market. Sources: own calculations, Eurostat, EWEA

Demand has fallen, supply has increased in the EU electricity market. Sources: own calculations, Eurostat, EWEA

Horrific renewables prices

So what happened? The most significant growth came from items “below the line”, those which are added onto low wholesale prices. To be more specific: Europe has witnessed a surge of capacity growth in wind and solar PV renewable energy because of the 2020 renewable targets. But the problem lies in the fact that these generate electricity at much higher costs than the majority of power plant capacities, and so CO2 savings are also excessively expensive. In the case of wind turbines, the price of producing 1 MWh is somewhere above €100, while solar panels are even more costly. New capacities are becoming cheaper (though still well in excess of current electricity prices), but this doesn’t solve any problems retroactively – if an investment has been completed, then someone (typically) the investor has already paid the higher electricity cost in advance.

Europe is currently paying this surplus little by little, in the form of higher energy costs. In Germany, renewable subsidies exceed the price of baseload power. Of course who pays the burden of this cost varies country by country. In some cases, residential consumers are protected, and industrial users are forced to pay more, in other cases it is the other way round. As the EU figures show, the overall burden on industrial consumers has risen substantially.

Whichever direction the cross-financing occurs, it will have serious economic implications, since it distorts the behavior of market players. Keeping household energy prices at artificially depressed levels induces greater consumption, thus discouraging savings and energy efficiency improvements. On the other hand, high industrial electricity costs deter investment. Since competition is generally more intense on end-product markets, investments are shifted wherever costs (i.e. energy prices) are lower.

And, as we have already explained, renewable subsidies have already undermined the EU’s emissions trading system. The targets, to put it mildly, are not well aligned.

Single market? Don’t hold your breath…

While in many cases renewables were over-subsidized on the national level, there has been relatively less attention devoted to the development of the EU’s single energy market, although progress has been made in certain areas. For wholesale gas markets, practically every country, every contract comes with its own gas price. The linking of electricity markets has supported overall integration, thus contributing to price convergence. But there is still a long way to go.

Of course, doing business with renewables, cutting ribbons and taking part in photo-ops during inaugurations is much simpler, ensures greater media exposure and clearly infringes upon fewer entrenched interests than, say, increasing regulatory transparency on who has access to cross-border capacities, or where infrastructural upgrades take place, or even – heaven forbid – limiting price regulation in certain consumer sectors.

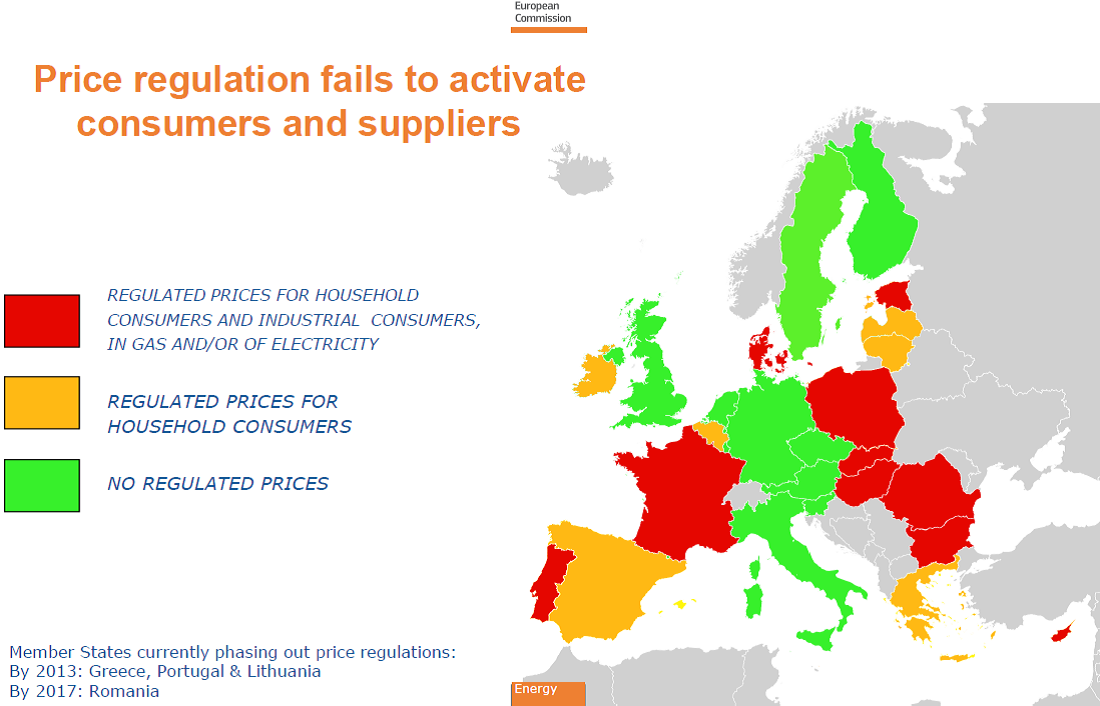

Energy prices are regulated in many EU countries. Source: European Commission

This is all currently still wishful thinking. In fact, the fragmented energy market is the other key reason for why EU electricity prices are so high. Local, often dominant service providers tend to keep their prices relatively high. If the market were more integrated, prices would also come down.

Market-weary politicians are a major obstacle to the single market; they are skeptical of the notion that imports can be just as stable and predictable a source of energy as “domestic” production. Herman Van Rompuy spoke (spooked) during the summit about Europe soon becoming the only continent dependent upon energy imports (which is not even true, since Asian imports are still rising).

But imports aren’t going to do the trick if we don’t believe in them. If I want “my producer” to raise output at the expense of “some else’s producer”, this can only be achieved through erecting artificial barriers to trade. This is why imports won’t, in fact, be equivalent to “domestic products”. National renewable targets are also pointing in this direction. To put it bluntly: If I spend stellar amounts on generating electricity through costly renewables, why would I sell it to other countries “cheap”?

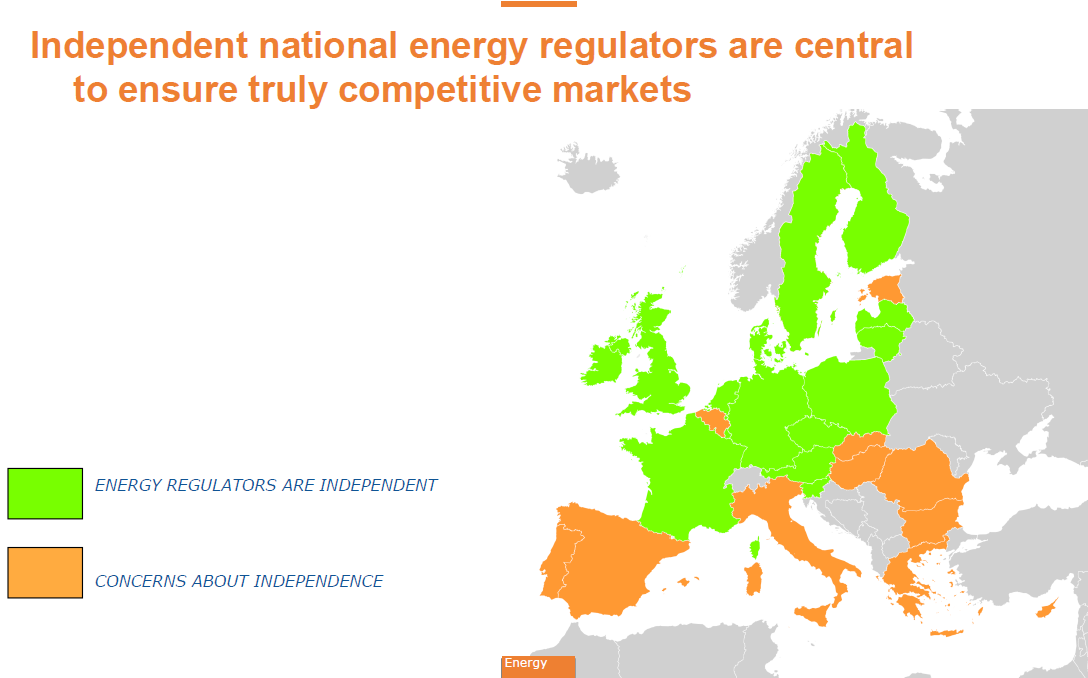

The independence of energy regulators is questionable in half of Europe. Source: European Commission

The independence of energy regulators is questionable in half of Europe. Source: European Commission

Schizophrenia remains

Of course, most energy market regulation is still in the realm of national governments, where the EU doesn’t have a say. And the power of EU enforcement has a mixed track record. Even if they are initiated, EU proceedings drag on for several years; punishments don’t have much of a deterring effect, even if some fines are imposed now and then. Only anti-trust proceedings seem to pack a real punch.

We have already seen that certain EU targets contradict each other, and that there’s always some more pressing issue on the agenda than energy. So schizophrenia will remain for the time being: much talk, little action. One step forward, two steps back.

A bejegyzés trackback címe:

Kommentek:

A hozzászólások a vonatkozó jogszabályok értelmében felhasználói tartalomnak minősülnek, értük a szolgáltatás technikai üzemeltetője semmilyen felelősséget nem vállal, azokat nem ellenőrzi. Kifogás esetén forduljon a blog szerkesztőjéhez. Részletek a Felhasználási feltételekben és az adatvédelmi tájékoztatóban.