Currently natural gas in the US is cheaper than the subsidized domestic gas price level in Russia. Even if this is unlikely to last, gas will be cheap, significantly cheaper than oil, eventually everywhere. This is going to be a truly enermous global supply shock. But the US will enjoy a cost advantage for years.

Probably by now, everyone has heard about the (US) gas supply revolution. New technologies (mainly hydraulic fracturing or fracking and horizontal drilling) have it possible to produce gas from previously useless shale rocks (and other formations) and this has made gas abundant in the US. This is a good technical introduction if you are interested.

The gas price has dropped to around USD 2/MBtu, or about USD 70/thousand cubic meter. This is very cheap: oil costs about 18$/MBtu in the US (and more like 20$/MBtu internationally), at least 9 times more expensive for the same heating value. Put it differently, gas in the US is currently priced at the equivalent of 11$/barrel oil. US gas at the moment is even cheaper than the subsidized Russian domestic gas prices. Even coal, so far the cheapest (if more CO2 intensive) energy source costs more. This is potentially revolutionary for many areas, not just energy. But before we get into the consequences, we have to try to answer the following questions: will it last and will gas be cheap outside of the US as well and if so, when? When I refer to gas being ‘cheap’, I mean that it is significantly below the price of oil in energy terms.

Will it last? Yes, gas will stay cheap in the US

This is mainly a question of politics and not technology or resources. Shale technology is already there, and is getting significantly more efficient even now. Resources are also there – there is some debate about what is technologically recoverable, but given that technology is improving, it is probably several hundred years of current US consumption, possibly even more. On some estimates, North America may have more gas resources than Russia, Qatar and Iran combined.

The real question is whether environmental worries about fracking will eventually lead to political intervention. This is becoming less likely as time goes on. Two years ago, the US gas industry was caught unawares by the environmental black-lash, epitomized by the film “Gasland”.

Now it is fighting back, partly by lobbying more intensively, but also cleaning up its act and becoming more transparent by for example publishing fracking fluid components. It is very likely that fracking is reasonably safe if done properly.

What may be even more important, the US is getting hooked on cheap gas. From president Obama down everyone is now talking about how it will lead to a manufacturing revival and jobs bonanza. Of course things are not this simple in macroeconomics – a supply shock in energy will lead to a stronger dollar, more jobs in energy intensive sectors but less jobs elsewhere as non-energy industries are becoming relatively less competitive – Saudi Arabia is not famous for its job bonanza as a result of cheap energy. But I am running ahead to the consequences. What is important here is that there is a strong constituency who believes in being worse off should cheap gas sources be turned off, and will lobby for keeping the gas flowing.

Who would dare to torpedo a jobs bonanza?

So overall it is likely that shale gas will keep on flowing in the US, though the current extreme low prices are not likely to last. 4-5$/Mbtu seems a more likely long term marginal costs in the US, which is still very cheap, that is around 25$/bbl in oil price terms. Currently the gas price is depressed due to the large inventories after the warm winter and the fact that oil is so expensive. The latter argument may seem to be counter-intuitive, but what is happening is that “wet” gas resources that contain liquid hydrocarbons keep on producing gas as a by-product, even if gas prices are very low. It is the liquid production (that is priced off crude oil) which keeps them economical. Some “dry” gas wells, which do not produce any liquids, are shutting down at current prices.

But it is possible that further technological developments conserve the current extreme low gas prices – the unconventional gas revolution is relatively young, and so far the surprises were all on the side of cheaper gas. And such price levels would not be something completely new: after all the price of natural gas in the US hovered around 2.5$/Mbtu all through the 90’s. (But of course, oil prices were around 20 USD/bbl back then).

As far as gas and oil relative prices are concerned, the current gap is likely to close only if oil becomes cheap as well.

Will gas be cheap outside of the US as well, and when? Yes, but it will take a decade

The curious thing about natural gas is that there is no global market, and the current price differences are huge across regions. That is because transporting natural gas is more cumbersome and costly than transporting oil, compared to the value of the stuff and requires dedicated infrastructure. That’s one of the few disadvantages of a fuel in gaseous form (but it is not insurmountable, see later).

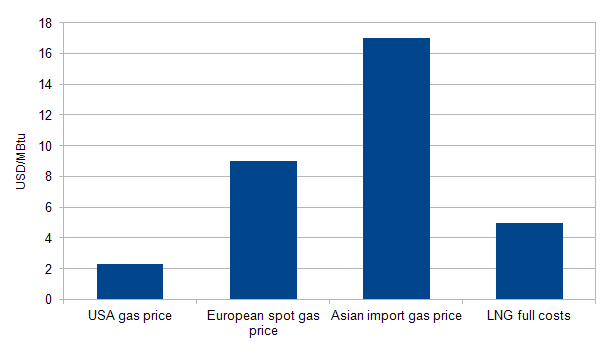

Prices are the lowest in the US with 2$/MBtu (leaving aside cases of natural gas being flared in many places - in which case its local value is probably negative), while at the other extreme natural gas prices in Asia are still linked to oil or oil products, and are around 17$/Mbtu. Europe is somewhere in between, and is itself divided: there are still legacy oil linked long-term contract prices (as in Asia), typically with Gazprom (although consumers are increasingly capable to negotiate discounts). And there is a cheaper spot market with prices around 9$/MBtu. This sounds like the segmented global market in spices before sea transport became cheap and reliable. And arbitrage will eventually result in the same kind of price convergence as with spices.

We have hidden an arbitrage opportunity on this picture

This price divergence is only a few years old, and comes from the fact that the shale gas revolution in the US had depressed prices there, which had some ripple effects in Europe. Huge price differences among continents can only exist because it takes time and considerable investment to build up the intercontinental transportation infrastructure. And to do that is risky, because by the time the investment is commissioned, prices may converge..

There are two main ways to achieve lower natural gas prices outside the US: the rest of the world discovers their own cheap gas, or they transport it from cheap producers.

Transport costs are lower than the current price differences, but need infrastructure

Long-distance, intercontinental transport of gas is mainly done by LNG (liquefied natural gas) ships - this mode of transportation saw a doubling in volumes since 2005, and further fast growth is on the cards. But currently only about 10% of the total amount of gas traded is shipped in LNG tankers. Cheap US gas is too recent for the US to have any export infrastructure - indeed it has been an LNG importer until recently. Now there are several plans to build LNG export (liquefaction) terminals in the US, the most advanced is the transformation of the Sabine Pass import terminal by Cheniere Energy in the Gulf of Mexico.

Cheniere already has contracts to sell the gas, and the pricing formula is very interesting: it is US gas prices (in Henry Hub) times 1.15+$2.25 to $3/Mbtu. This means that at current prices, you would get the LNG for about $4.6-5.3/Mbtu (or about $160-185/thousand cubic meter). Allow around $2-3/Mbtu for shipping, but even then the price is a steal in Asia. We don't know what the US price is going to be when the export plant start operating (planned for 2015), but these kind of contracts are likely to lead to a more integrated global gas market and price convergence. US exports are likely to reduce Asian prices, and increase US ones.

As a rule of thumb, the LNG transportation value chain (liquefaction, shipping, re-gasification) is worth about $4-5/Mbtu (or $140-180/thousand cubic meter), so in the long run, when the necessary infrastructure is built up, there should not be, on average, much larger price differences among major market economies, if there is no obstacle to arbitrage. But to build up that infrastructure will take at least a decade. The Sabine Pass export terminal will cost $6 bn, and will be able to export only about 3% of US natural gas production.

Price convergence may also be restrained by export restrictions. Some large US energy users are lobbying for a 10% cap on gas exports. Of course if a 10% cap is credible, it would accelerate the rush to build export facilities: if you have an export permit, you can benefit from the price difference, but it will not be competed away as further entry is restricted. It would pay to be among the firsts. But of course how long such arrangements - granting extra profits for selected companies - are politically feasible would be a question.

Gas OPEC unrealistic, and has become less realistic with unconventionals

Overall it is likely that large global gas price differences will incentivize building up the necessary transport infrastructure. Political resistance/protectionism will be overcome as well - when you have potential returns of several hundred percent, then there are resources to convince politicians as well - by bribing or lobbying, depending on the political arrangements.

Also, a "gas OPEC" - a supplier cartel - is a realistic possibility. Gas is just getting too abundant for that globally (see below). Also, importantly, much of the potential new gas supply lies in market economies, where competition laws generally forbid supply cartels, and they are not practical among competing private firms (as opposed to state dominated monopolies in many of the traditional gas producers).

Cheap gas everywhere? Yes, but developing it will also take time

The other way to lower gas prices in market economies outside the US is to produce gas cheaply elsewhere too. The US was a pioneer in unconventional gas because it has very efficient energy and other markets and some other factors like gas transport infrastructure in place and the fact that land owners also own mineral resources lying below their land. Australia is becoming a major exporter of unconventional gas, too. Others may produce at a higher cost, and they may run up production at a slower pace, as they are less efficient economies.

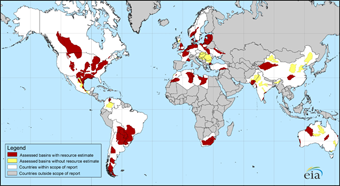

Again, the main constraints are above-ground. There are huge non conventional gas resources on practically every continent, including non-Russian Europe. Some of these could probably be produced cheaply, given the right incentives.

But the right incentives may be slow in coming. France and Bulgaria (and recently Romania) has banned fracking, and there is a pressure from environmentalists to do the same in Germany. The UK had a temporary ban, after fracking allegedly triggered small earthquakes, but it is now relaxing it. Poland has embraced fracking, without much result so far. Ukraine has large resources, but also a hostile business environment. Argentina is a similar story. The consensus is that there is little prospect for unconventional gas production in the EU before 2015, and only small quantities by 2020 (5% of consumption at the maximum, but probably much less).

China is probably one of the most promising environments for unconventional gas outside of the US: it has political backing there and China seems to have the resources. Also, the country has a relatively friendly environment for business and a rapidly growing domestic market.

Its politicians want to boost domestic unconventional gas production from zero to 60 bcm (billion cubic meters) by 2020. That would be significant, but still only about 20% of Chinese consumption by then. Also, industry experts have their doubts - the geological formations are difficult, you have to partially re-invent shale technology (as you have to at practically every location).

But looking at the larger picture, these hurdles will only slow the build-up of (unconventional) gas supply outside of the US, - the trend will be there. There are also conventional gas finds that boost global supply (East Africa, Israel/Lebaon/Cyprus). But the time scale of these producing commercially is also around the end of the decade - the industry has long lead times.

It seems that the US will enjoy about a decade of singularly cheap gas prices compared to other market economies before the price difference will narrow significantly. At the same time cheap(er) gas is going to be increasingly available during this decade globally. In the next piece we will look at the consequences of all this.

A bejegyzés trackback címe:

Kommentek:

A hozzászólások a vonatkozó jogszabályok értelmében felhasználói tartalomnak minősülnek, értük a szolgáltatás technikai üzemeltetője semmilyen felelősséget nem vállal, azokat nem ellenőrzi. Kifogás esetén forduljon a blog szerkesztőjéhez. Részletek a Felhasználási feltételekben és az adatvédelmi tájékoztatóban.