The IEA’s World Energy Outlook in 6 charts.

Here is our pick of top charts from the IEA’s latest annual World Energy Outlook (WEO), as promised in our earlier post. These are about the big trends that we (mostly) agree with. In yet another follow-up post we will also write about that the things we think might turn out differently from what the IEA expects…

This selection is admittedly subjective, and of course we had to leave out a LOT of important things (really a lot: remember, the WEO is around 700 pages long). If you have your own, different choice, leave a comment or send us an email. Some of this may be well known to those who closely follow the energy sector, but there might also be some surprises...

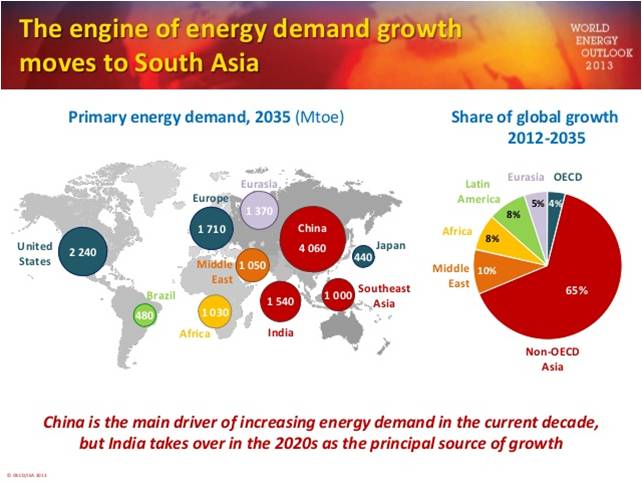

The story of energy demand growth is an Asian story. The IEA predicts that ¾ of energy demand growth between 2012 and 2035 will happen in Asia. The OECD seems to be a footnote in this story: by 2035, China alone is likely to be a bigger energy market than the US, Europe and Japan combined.

Source of all the charts below: IEA World Energy Outlook presentation

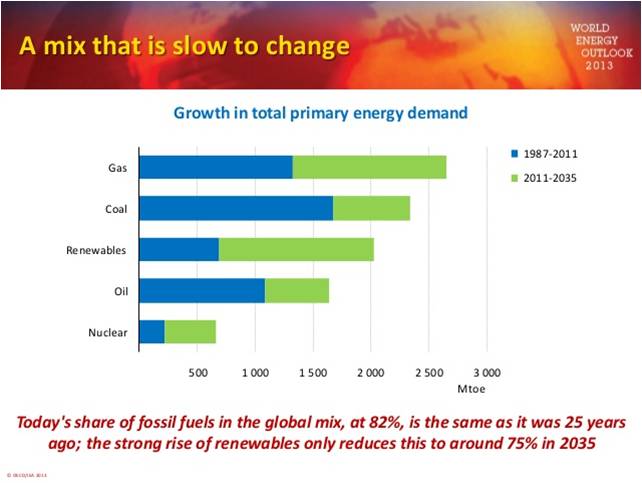

In terms of energy sources growth, the IEA predicts that natural gas and renewables will lead. We are also bullish about natural gas, as we explained here, here and here. Gas is an abundant and thus cheap fuel; in addition, it is much less harmful to the environment than, say, oil or coal. Renewables growth, on the other hand, is to a large extent dependent on subsidies, and is thus less predictable. Nonetheless, the IEA predicts an increase of renewable subsidies from $100 bn in 2012 to $220 bn by 2035.

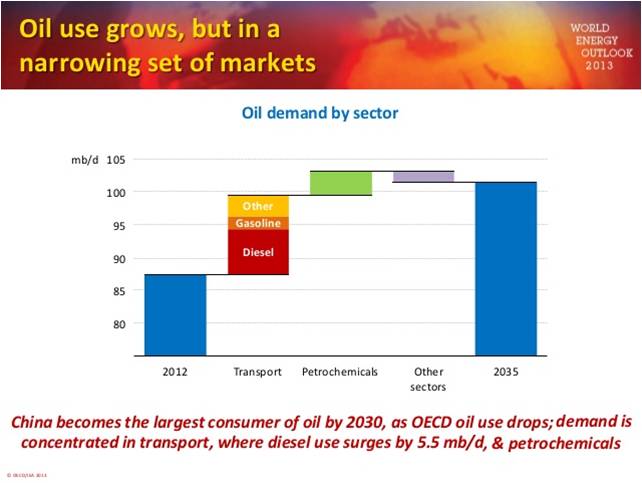

Oil demand will only increase because of transport use (and, to a smaller extent, petchem). Cheap gas makes most non-transport oil use uncompetitive in the long run. Also note that the IEA expects only a 16% increase in oil consumption over 23 years, while the size of the global economy will roughly double. Oil is an expensive energy source, and the global economy will therefore use it sparingly (as we have seen in the past 10 years as well).

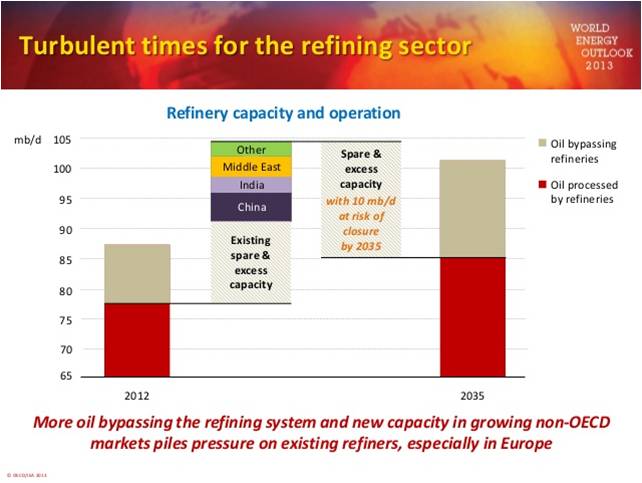

Refining will have huge excess capacities, and more closures will happen. At least 13% of the currently existing capacity is likely to stand idle or close by 2035 (this is mostly in OECD countries). Most of the new, competitive capacity will be built in – you guessed it – Asia. Overall refinery demand growth is even lower than the rise in oil use, as an increasing quantity of liquid hydrocarbons bypasses refineries (e.g. natural gas liquids and biofuels).

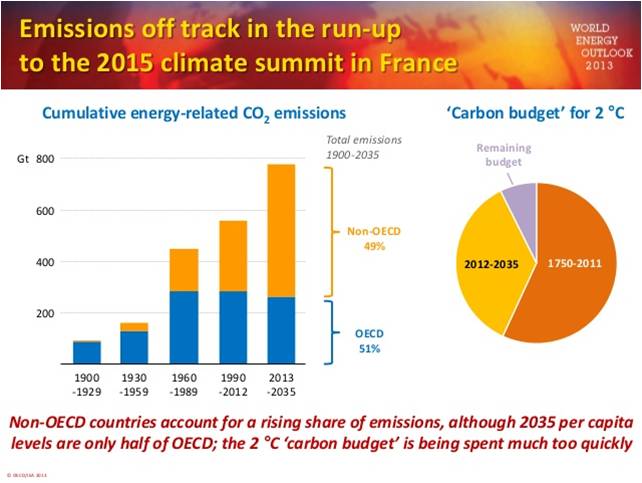

Forget about limiting global temperature rise to 2 C°. The IEA is still not emphasizing it too explicitly, but in order to achieve the 2 C° target, CO2 emissions would need to peak before 2020.. Given the inertia of existing infrastructure, there is no chance of reaching the target other than an economic collapse or coordinated, large-scale government intervention. The IEA’s forecast for the long-term temperature increase is actually 3.6 C° - this is enormous!. CO2 emissions are actually increasing, not peaking. Between 2012 and around the 2040s, we are likely to emit roughly as much CO2 again as since the beginning of industrialization in the 18th century.

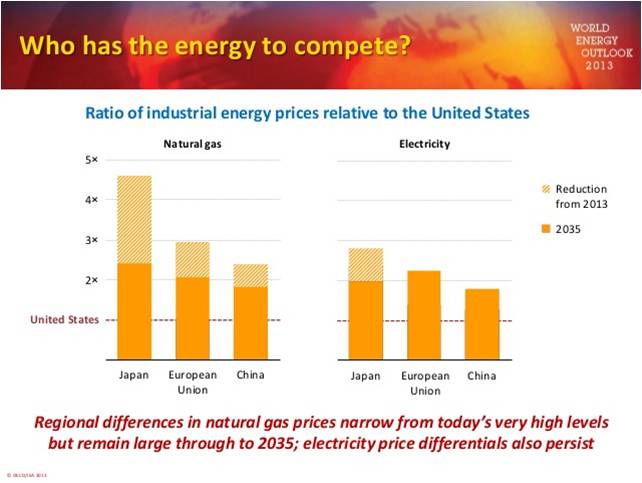

Energy will be cheap in the US for the foreseeable future – even compared to China. This is because the country has been allowing markets to work in the energy sector. This gave the US a headstart in shale gas production, and means that it will turn into a net gas exporter. Europe and China will remain importers, and because gas is expensive to transport, the prices there will be way higher (despite a slow and gradual convergence between regional gas prices). Also, cheap gas + markets = cheap electricity. As a result, energy-intensive production will migrate to the US, while the EU and Japan are set to lose a combined one-third share of their export markets in energy intensive industries because of uncompetitive energy costs.

In summary: ‘business as usual’ in a way… Or maybe not? Stay tuned for the top 5 things that we think might turn out quite differently from the IEA’s Outlook.

A bejegyzés trackback címe:

Kommentek:

A hozzászólások a vonatkozó jogszabályok értelmében felhasználói tartalomnak minősülnek, értük a szolgáltatás technikai üzemeltetője semmilyen felelősséget nem vállal, azokat nem ellenőrzi. Kifogás esetén forduljon a blog szerkesztőjéhez. Részletek a Felhasználási feltételekben és az adatvédelmi tájékoztatóban.