Gazprom faces money troubles – it simply has too much.

Guest post by András György Deák, Associate Fellow at the Hungarian Institute of International Affairs.

While some changes are apparent even from a European perspective, many fundamental shifts are much less publicized. Despite the woes of Europe, Gazprom is making record profits, thanks to more expensive gas sales to its neighbors. It has also renewed its production base successfully (and relatively easily) over the past few years. However, if Gazprom cannot spend a large portion of its surplus revenues, the Russian government will surely want to lay its hands on it. So the company tries to escape by moving forward.

Gazprom chief Miller. Putin in the background. Source: novinite.com

Times are changing, so is Gazprom

Gazprom has traditionally always been sensitive to demand security (yes, this concept exists as well, the supplier also wants security). Nonetheless, it made unprecedented concessions to its European buyers in 2012. Although this process started directly after the onset of the global financial crisis in 2008, as a major trend it has only recently expanded to the whole European (including Central and Eastern European) portfolio. With hindsight, it is apparent that the changes affected almost every element of the contract structure: above natural decrease, Gazprom’s total contracted volume (fixed until the end of the 2030s) has almost certainly dropped by 10%, spot-pricing is on the rise, and the role of oil price-indexing has diminished somewhat; in fact, the company has even made price concessions on the latter. These changes have cumulatively resulted in a 15-20% price decrease on average compared to sticking with pre-crisis oil-linked indexes. The typical contract duration has also declined: while in 2006 Gazprom renewed its portfolio through 20-25 year contracts, the Russian company is now inking deals that generally cover 10 (or even fewer) years; it is even willing to sign shorter, 2-3 year supplementary contracts with larger customers. Gazprom’s European behavior is obviously much more flexible today than it was a few years ago.

Regardless of the fact that as net importers of Russian gas, we should be delighted by these developments, there are several different explanations for its motives and the future of this strategy. There is no doubt that Gazprom – similarly to Sonatrach, the Algerian NOC – was slow to adapt to rapid changes in the post-crisis gas market, especially compared to other European pipeline and to some LNG exporters. Gazprom’s prices are higher, and its contractual obligations seemed exaggerated in light of European realities. Thus the danger of losing its market share obviously looms/loomed over the company’s head. In this interpretation, these steps were a result of export market pressures, where Gazprom had no other choice than to adapt. Nonetheless, many see Gazprom’s policy of “small steps” as more wise and revenue-maximizing than the radical shift and early price concessions made by certain European companies (i.e. Statoil). Others point to internal infrastructural constraints, small production, and even smaller transport capacities as the main reasons for Gazprom’s higher prices. Still others highlight the company’s loss of direction and lack of strategy, especially given the apparent conflict between Gazprom and its export company, Gazpromexport. Finally, there may also be some truth in explanations that since Gazprom is making record profits in Europe, its position allows it to make some price concessions: according to its own figures, its net price levels (without direct taxes and customs) in its non-FSU export markets grew 2.3-fold between 2005 and 2011. We’ll have to wait and see whether this proves to be just a correction, or the first step of a new marketing strategy.

Gas is less of a political tool in “near abroad” areas…

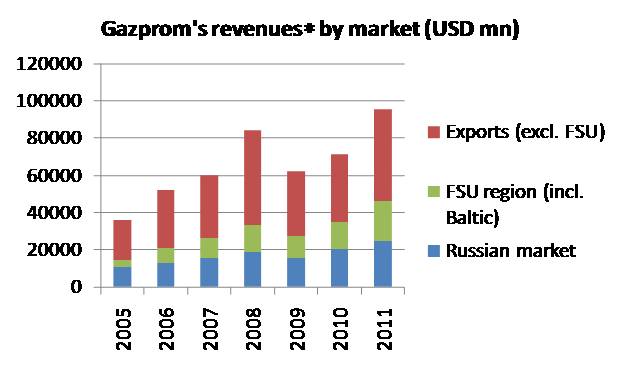

Nevertheless, there is another structural shift, of similar importance, and with similarly profound implications, which should not be underestimated with regards to the change in export strategy. If we take a look at Gazprom’s complete trading portfolio, we see several developments contradicting the above. Since 2006, both direct and indirect oil-linked indexing, as well as the average contract duration has grown. Gazprom’s whole contract structure is more oil-indexed and fixed than it was 7 years ago. The other two market segments, domestic Russian industrial tariffs and the FSU market are responsible for this. In 2007, the Russian government gave up its policy of arbitrary internal price-fixing, and instead adopted the principle that industrial prices should converge to net-back export prices (meaning available export prices minus transport costs and export customs). Of course in practice this is just a directive on price-indexing by authorities, but the government has generally complied with it. Nowadays Gazprom makes a profit on the domestic Russian industrial gas market, previous cross-financing has been eliminated from the system. In parallel, Gazprom was able to sign typically 5-year contracts on the majority of its industrial supply. Similarly, until 2006 it generally used annual contracts to determine volumes and prices for the CIS countries. These negotiations were motivated by politics, and gas was sold at arbitrary prices, far below the European price levels. Three years on, in 2009, all of Gazprom’s regional contracts were oil-indexed, fixing the most important parameters on a 5-year time horizon at least. Decreasing pricing and political risks resulted in a steep hike in revenues: in 2005, the average domestic price level (for both residential and industrial consumers) and post-Soviet prices were 25% and 35% of European export prices, respectively; by 2011, they were 30% and 85%.

*Net of taxes, royalties and tariffs. Source: Gazprom

…which expands Gazprom’s room for maneuver

Therefore, it is more accurate to say that Gazprom could face the global market turbulences of the post-crisis era with a pacified hinterland, and under much less political and pricing pressure. Because of the former, it was able to take on a lot more market risk; because of the latter, it had to take on a lot more risk. Gazprom’s management was presumably much more imaginative and flexible in a situation where almost half of its revenues were forecast using algorithms, several years in advance, based on global price trends, rather than when this was decided in presidential palaces and at government meetings in Kiev, Minsk or Moscow, on an annual (or even just monthly) time horizon. European export market revenues are not (necessarily) hidden any more on offshore bank accounts to prevent them from being used to cross-finance the domestic market. So in a certain sense the European consumer was one of the beneficiaries of the poor fate of its Ukrainian, Belorussian or Russian counterparts.

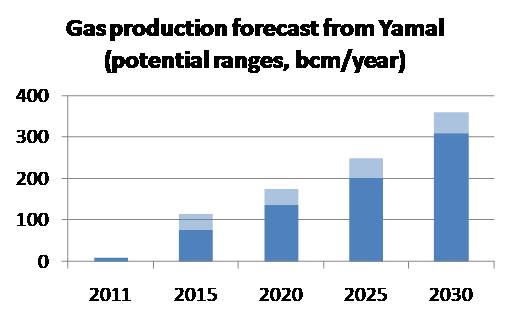

Yamal field solved production problems for a long time

If we look back at the challenges cited by the press in the middle of the last decade, it is apparent that Gazprom overcame these strategic difficulties with relative ease. At the time, everyone saw the depletion of existing fields as the major challenge, and questioned whether Gazprom could put new fields into production. By now, the company has renewed its production base – output from the Yamal peninsula will soon reach 150 bcm (equivalent to the total European export) and the specific cost of doubling volumes is much lower. Gazprom is upgrading and expanding its pipeline system at whirlwind speed. Furthermore, many suspect that the revenues of its gas arm are now used to finance oil and petchem development.

Mega-project. Source: Gazprom

The government also has its eyes on the prize

Obviously the regulator, in this case the Russian state, also wants to lay its hands on these surplus revenues. However, it seeks these rents not through price-fixing, but through the tax system. Because there is a strict finance minister with greedy superiors, who are zooming in on the finances of other mining sectors now that they usurped rents from the oil industry. Despite the annual average oil price reaching record highs, the Russian budget currently only breaks even. The substantial piling up of reserves, which characterized the pre-crisis years, has ground to a halt. It is no surprise that there are several proposals on freezing domestic gas prices or increasing gas royalties lying on the desks of Russian ministries, and – in light of current fiscal realities – Gazprom is less and less able to combat such attacks. The risk of tax hikes looms mightily above Gazprom, and it is increasingly weighing down on the company.

So Gazprom tries to escape by moving forward

Nonetheless, every organization that wants to preserve its budget must be able to showcase some politically attractive and commercially viable goals. If Gazprom cannot come up with large-scale, costly projects, then the budget will simply take this money from them, probably in the form of higher taxes. In such a case, the grim-faced management would have to not only watch the opening of new ski resorts in Chechnya or the inauguration of yet another nuclear submarine on TV, but – if the weather were to take a turn for the worse – they could be forced to petition the government for the easing of taxes. In the game of budget-bargaining, the surest way to avoid tax hikes is to embark upon yet another new project.

Therefore, if we look at Gazprom’s investments on a project level, several of them seem to be crazy ideas. For example, many still doubt the realization of South Stream, since it involves spending stellar amounts of money just to transport gas more expensively. However, from a big-picture view, based purely on objective, analytical calculations, Gazprom would want to see the project completed, and this would even make sense from the company’s perspective. After all, it seems that the Russian political elite supports the idea both in principle and in practice.

A bejegyzés trackback címe:

Kommentek:

A hozzászólások a vonatkozó jogszabályok értelmében felhasználói tartalomnak minősülnek, értük a szolgáltatás technikai üzemeltetője semmilyen felelősséget nem vállal, azokat nem ellenőrzi. Kifogás esetén forduljon a blog szerkesztőjéhez. Részletek a Felhasználási feltételekben és az adatvédelmi tájékoztatóban.