The energy company is one of the largest local investors, and speaks the same language; sure it can manage country risk. Except when not.

By Péter Simon Vargha and Réka Sarolta Torma:

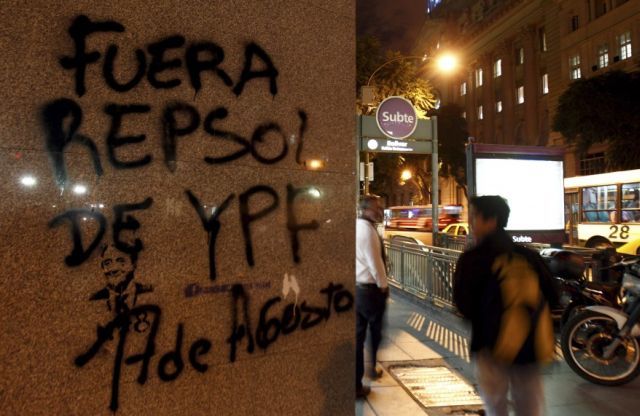

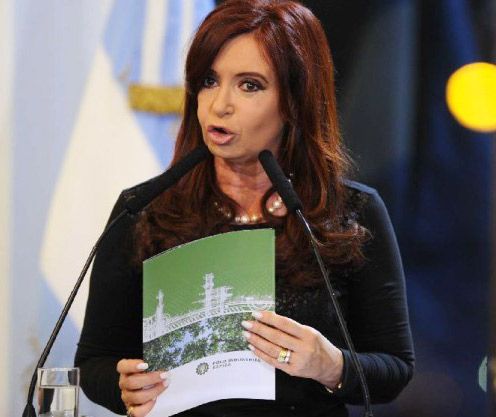

As Repsol, the Spanish oil and gas company had to learn it the hard way in Argentina. Last month Argentina’s president, Cristina Fernández announced the expropriation of Repsol’s majority stake in YPF, an oil firm with significant oil and gas production and reserves, refineries and retail chain in South America, which it had acquired back in 1999. We have read many opinions why Argentina will actually be worse off following the expropriation. http://www.naturalgasamericas.com/ypf/repsol-everyones-a-loser In this post we show through a simplified example what the level of risk premium could be if on average in every 12 years the assets of a firm are expropriated. We also show by how much this may increase the cost of investments in Argentina.

Our results show that (with the assumptions below) such a risk adds 600 basis points, full 6% to the required return. Argentina also loses on the case, altogether much more than it ‘won’ by the expropriation.

Let’s assume that on average in each 12 years (Repsol bought YPF in 1999) the asset is nationalized, so each year there is a 1/12≈8% chance of expropriation. Let’s also be generous and assume that a third of the value would be paid out in case of an expropriation. The initial return the investor requires is set at 10%. How much do we need to increase the required return (interest rate) for the valuation that compensates for the risk? Or differently, what should be the increased return if the investors are aware of this risk?

We find that in order to offset this risk of nationalization, investors would require a minimum of 6% extra return – versus the safe, predictable but lower return investment case (adjusted for the risk). (In theory, the required extra return could only be determined if investors were risk neutral, meaning they would be indifferent between any two cash flows with different probabilities as long as they have the same net expected value. As the investors are probably risk averse, the 6% should be considered as a theoretical lower bound on the extra return.)

The value of total gross investments in Argentina amounts to around USD 120 bn annually. If the required return on all these investments rises only by half of what we got above, i.e. by 3%, that adds up to an annual USD 4 bn extra cost. Of course majority of this cost will not mean higher investments, but will materialize in lower but more expensive investments in Argentina. Compare this to the USD 6-7 bn ‘won’ by the the state with the nationalization of the YPF stake, that is if you believe that a third would be paid back to Repsol, which in turn has said the fair value is around USD 10 bn. Single USD 6-7 bn revenue, on one hand, and 4 bn additional cost each year, on the other: does not seem to be a good business.

The general problem, then, of course is that the extra cost would be paid by investors, not the state, and the investors could also be blamed for the foregone investments – as was the case with Repsol as well. This leads to a vicious circle: investors require a high return to invest, but if the high returns actually materialize, the government deems that it can rightfully take away the so-called ‘extra profit’. Or if they do not invest, the state would still think it has a good reason to intervene.

A general defense mechanism in such cases is to try to get intertwined with well-connected local investors, a thing which Repsol did, too. It gave loans to the influential Eskenazi family, in order to boost the family’s stake in YPF. The family had originally been ‘pushed’ into YPF by Nestor Kirchner, then the Argentine president. But being well-connected does not last forever: according to reports the family fell out with Kirchner’s widow and successor, Cristina Fernández.

It is of course possible that other investors view Repsol’s case as an exceptional one, which cannot happen to them; or to the contrary, the investors think they had already calculated with the ‘right’ risk of expropriation and Repsol’s case did not change anything. Then, even before the recent case, investments were way lower than they could have been…

The question is whether such a case could be an exceptional one? Argentina’s recent history suggests that it cannot. This is confirmed by the latest story of Argentinian electricity companies facing bankruptcy and nationalization because of a freeze in tariffs.

And if the expropriation does not raise the risk premium any more, that is hardly any comfort, because investments could be much higher, if the risk had been ‘priced out’ , which could boost long run growth. But of course the pricing out takes much time and is much more strenuous for the state than putting its hand on something every now and then.

A bejegyzés trackback címe:

Kommentek:

A hozzászólások a vonatkozó jogszabályok értelmében felhasználói tartalomnak minősülnek, értük a szolgáltatás technikai üzemeltetője semmilyen felelősséget nem vállal, azokat nem ellenőrzi. Kifogás esetén forduljon a blog szerkesztőjéhez. Részletek a Felhasználási feltételekben és az adatvédelmi tájékoztatóban.