Dominant position on the most dynamic motor fuel market of Europe, efficient operations and of course the political background provided by the Koc family – these are the ingredients of the success of Tüpras, a Turkish refiner.

From time to time we are going to invite external authors as a contributor to our blog. The following is a post by Tamas Pletser, CFA, ING Oil and Gas Sector Analyst.

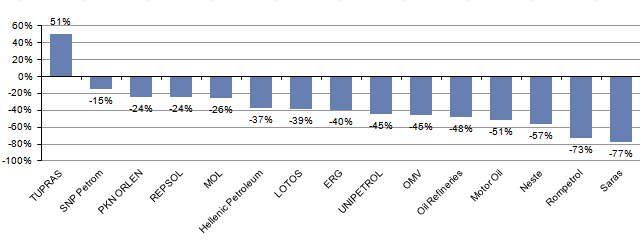

Looking on the performance of the EMEA refining sector in the last five years, there is one stock, Turkey’s Tupras, which outstands from the crowd by having 51% positive yield (price appreciation plus dividend in own currency) since end-2007 vs. the sector peers that had negative performances during this period. Tupras turned out not only to be resisting the crisis, but even yielding positive results in these difficult times. In this post I am looking at the ingredients of this success.

Stock price performance of European and EMEA refiners

Sources: Blooomberg, ING

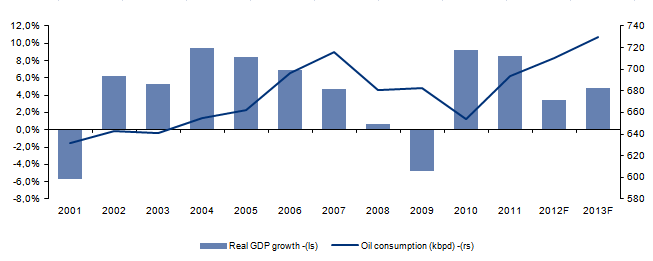

Tupras has a special position within the ailing EMEA refining sector. First, it operates in Turkey, the country, which some consider to be the China of Europe and which country grew at an astonishing rate in the last ten years boosting also the refined product consumption.

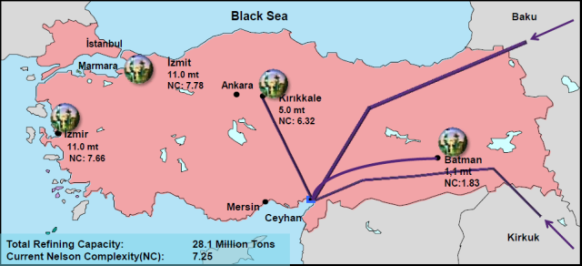

Second, it is the sole refining company supplying Turkey. Tupras operates two larger refineries in the Western and North West part of the country close to large cities like Istanbul and Izmir, supplying the neighbouring densely populated areas, while Kirikkale in adjacent to Ankara has a role to supply the capital and the middle of the country besides producing petrochemical feedstock. The Batman refinery in the South East part of Turkey populated by Kurdish people is processing the locally produced heavy oil.

Third, Tupras has a dominant position in logistics: it holds majority of ports, storages and other logistics facilities within the Turkish borders. Interestingly the country acts rather like an island from the logistic point of view. It has only few ports deep enough to allow facilitating larger vessels – Tupras is present at all these strategic points. This dominant position is visible in the pricing of fuel products: the company is rather a price-setter in

GDP growth Turkey

Sources: ING, BP Statistics Review

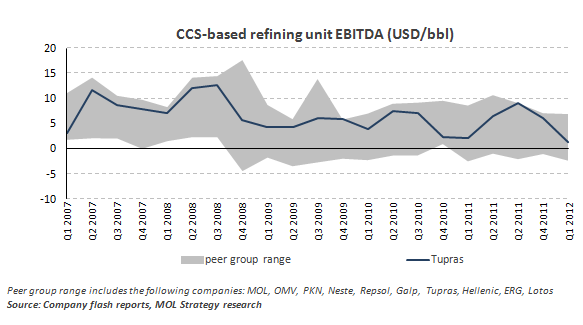

Flexible and efficient operation

Flexible and price sensitive crude oil procurement, and a daily optimization of imports and own production are also supporting the success of the company. The company receives crude oil from all parts of the world, typically medium and heavy blends and medium and heavy in relation to sulphur content. Middle East and Russian suppliers are especially like to deliver to Tupras due to its geographical closeness, as they do not need to ship their crude to

The picture has changed this year due to the sanctions against

The importance of a supporting family…

The success of Tupras is also highly contributable to the fact that the controlling 51% stake is held by the Koc family, one of the largest family-based holdings of Turkey. ,. The Koc family is now run by the third generation after the founder Mr. Verbi Koc started to accumulate wealth in 20s and 30s and established the holding company in 1963. The Koc Group is present in Turkish energy (LPG trading and retail, refining, fuel retail and power generation), banking (Yapi Kredit), electronics and white goods (Arcelik, Beko) or even in car manufacturing (Ford Otosan, Türk Traktör).

In

The company had a 90% dividend payout ratio over the last 5 years and it does not intend to change this policy. The stock is trading with approx. 9% dividend yield with the estimated dividend for the next year.

It is not a coincidence that these families are not considered to be oligarchs like their Russian counterparts who lavish their quickly accumulated wealth from the country abroad usually on luxury goods.

…and a supporting government

There is also a kind of a silent agreement in refining between Koc and government. On one part, Tupras could set the prices some 3-5% above the

From investors’ point of view the relatively large distance between local politics and Tupras is positive as the decisions are made mainly on commercial and economic basis, not on political one, while Koc as a private shareholder intends to achieve the highest efficiency within the group. From analytical point of view this is a very important – experience is that energy is considered as a strategic industry all over and politicians tend to influence the decisions everywhere with certain extent. The greater distant to politics is desirable, which allows shareholders’ value creation to prevail the most as the key purpose. Importantly there are no major disputes over the heritage or other topics within the Koc family (you might think about the story of Mittal brothers in

A bejegyzés trackback címe:

Kommentek:

A hozzászólások a vonatkozó jogszabályok értelmében felhasználói tartalomnak minősülnek, értük a szolgáltatás technikai üzemeltetője semmilyen felelősséget nem vállal, azokat nem ellenőrzi. Kifogás esetén forduljon a blog szerkesztőjéhez. Részletek a Felhasználási feltételekben és az adatvédelmi tájékoztatóban.