You may end up doing strange things when you feel cornered. Iran, for example, is even allegedly considering creating a huge oil spill, which would block the Strait of Hormuz and force the West to temporarily suspend sanctions during the clean-up. Let’s hope things don’t go so far: below we summarize possible scenarios for Iran.

Efforts to force Iran to halt enrichment (and ultimately abandon its nuclear program) are faltering. International monitors left the country in February, multilateral negotiations are deadlocked. Instead, increasingly punitive sanctions are being imposed – and they are actually proving far more effective than generally thought. So far, the United Nations, the United States and the European Union have introduced a lengthy catalog of sanctions including bans on nuclear technology and heavy weaponry imports, travel bans and asset freezes, denied transactions with Iranian financial institutions, etc. The list goes on and on… You name it, it’s banned.

To give you a specific example from Hungary: recently we have heard that Iranian foreign exchange students studying at Hungarian universities (of whom there are surprisingly many) have a hard time paying their tuition fees.

On 1 July, an EU oil embargo came into force; a rather harsh move for a country that used to export 20% of its oil to Europe. The repercussions can be felt throughout Iran, from its debilitated energy sector to increasing socioeconomic tensions.

Sanctions hurting Iran big time

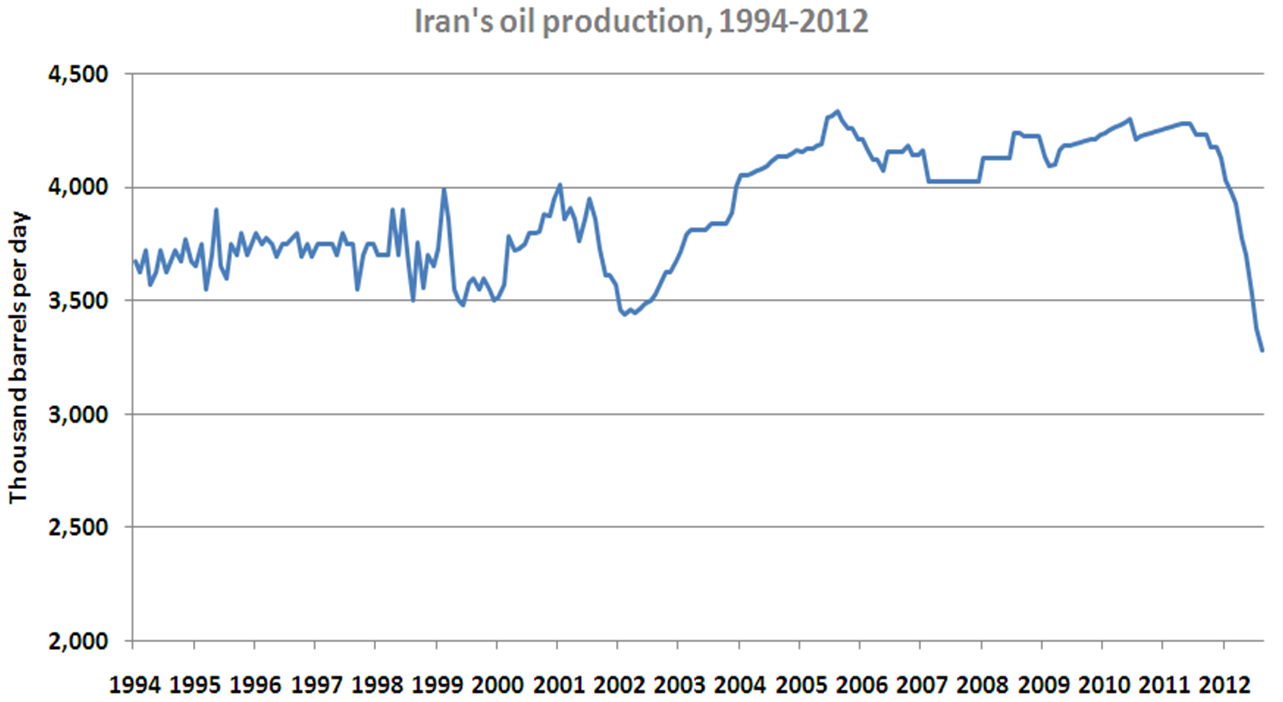

Most of the time, sanctions are not very effective, and eventually this could be the case with Iran as well. But so far they are proving very painful. The energy industry is Iran’s lifeline – it accounts for around 80% of export revenues. Production, which exceeded 4 million barrels of oil per day (MMbopd) at end-2010, has fallen to around 3 MMbopd following the imposition of the EU embargo. In fact, July daily oil production figures were at their lowest level since the end of the Iraq-Iran War in 1988.

Into the abyss?

Into the abyss?

Source: U.S. Energy Information Administration

Israeli finance minister Yuval Steinitz has declared that Iran will lose USD 45-50 bn in oil revenues by end-2012. More strikingly, the Iranian rial has depreciated by approx. 80% since January. In early October it was in free-fall, losing more than 25% of its value against the US dollar over the course of just a few days. This led to the government firmly restricting currency trading, a clear sign that the sanctions are indeed biting.

Meanwhile, food prices have roughly doubled (and Iran is a major food importer); there has even been talk of unrest, albeit on a small scale. Unemployment, which officially stands at 12%, is many times higher. It is rising fastest among the young – particularly problematic in a country where half the population is under the age of 25. The leadership tries to divert attention from such economic worries, referring instead to what it sees as the success of its self-reliant “resistance economy”.

The pressure of sanctions is exacerbating internal political divisions. There are tensions between President Ahmadinejad and Supreme Leader Khamenei, as well as between conservatives and “reformers” within the political elite. With the date of the next presidential election set for June 2013, political battles are likely to become more polarized.

Although its nuclear program is a source of pride for many Iranians, bolstering governmental popularity and legitimacy, the effect of sanctions and diplomatic isolation cannot be staved off indefinitely. So what possible decisions are there for the Iranian leadership at the moment?

First off, it can continue to play the waiting game: accelerate bomb development, in the hope that becoming a nuclear nation can inspire greater fear and respect abroad. So far, this seems to be their plan A. But this option assumes that the US and Israel will just sit back and watch. They may not do so, in light of Israeli PM Netanyahu’s (in)famous speech at the UN General Assembly in September…

Drawing a red line on the Iranian nuclear program – literally

Drawing a red line on the Iranian nuclear program – literally

Source: Yahoo! News

The second scenario is that Iran’s leadership thinks it cannot domestically withstand the debilitating effects of sanctions on its economy, and engages in some sort of diplomatic overture. Let’s not be so naïve as to imagine it voluntarily giving up its nuclear program, though it may perhaps be willing to let international monitors re-enter the country, or agree to further multilateral negotiations. But all this sounds a bit too good to be true, for the time being at least.

Third, and most frighteningly, Iran may feel increasingly encircled and act out of desperation. It is already losing key regional allies (such as Syria’s President Assad) amid fears of Sunni dominance in the Middle East, while the presence of the US military in the Gulf is still a sore spot. Iran’s political elite could fear that making any concessions regarding the nuclear program would risk the country’s credibility and potentially lead to unrest flaring up once again, as it already did following the 2009 elections. Who knows how Iran would react if it feels backed into a corner?

The fourth possibility is that the Iranian leadership may miscalculate, and it would not be calling the shots any more, swept aside by some kind of “Persian Spring”. This is probably the hope of most of the countries imposing the sanctions. It is a possible medium-term outcome, especially since the regime needs money for domestic oppression as well. But the short term dynamic may be that of “rallying around the flag” – it is unpatriotic to rebel when the country is under attack. Whatever the case, the possibility of losing power again may make the political leadership feel cornered, caught in the crossfire between foreign and domestic enemies alike…

Dire straits

And when you are feeling cornered, you may do strange and irrational things – the Iranian leadership has already resorted to threats of closing the vital Strait of Hormuz. This would be a disaster for energy markets – and also for Iran. It is one of the world’s most strategically important choke points, a narrow maritime strip connecting some of the most significant oil producers with global markets. Approx. 17 MMbopd flow through it in a single day – this is equivalent to around 35% of global seaborne oil exports (and 20% of all oil traded globally). Furthermore, 20% of the global LNG trade and around 2 MMbpd of refined oil products pass through.

Iran’s threats to close the Strait of Hormuz are nothing new. It has been hinting at the option since 2008, and is openly warning of this since early this year. The chief commander of Iran’s navy has even stated that closing the Strait would be “easier than drinking a glass of water”. The key question, though, is how exactly Iran would do this. According to military experts, Iran’s navy cannot unilaterally uphold a physical blockade. Most of its boats are rather small, and cannot sustain the blockade in a coordinated naval formation for a longer period of time. Sinking an oil supertanker is no easy feat either – they tend to be more sizable and durable than a warship, you cannot simply drill holes at the bottom. But Iran has other options at its disposal: mine-laying, missile hits, suicide attacks… (And these options are not unheard of: Iran already mined the Strait in the 1980s, during the Iraq-Iran War.)

Several countries have already started preparing contingency plans for the closing of the Strait, and are searching for bypassing options. At the moment, only Iraq and Saudi Arabia possess both the necessary pipeline infrastructure and surplus capacity to ship oil outside the Gulf. Total unutilized surplus capacity was just 1 MMbopd as of early 2012, a mere of 6% of potentially lost output. This could flow through the Kirkuk-Ceyhan pipeline connecting Iraq to Turkey, or via the Petroline (a.k.a. East-West) Pipeline in Saudi Arabia. Another option, available only to smaller vessels, would be to sail closer to the Omani shoreline in the Strait, but that is fairly risky, even with the Bahrain-based US Fifth Fleet patrolling nearby to ensure the security of the Strait.

Murky waters

It seems, however, that with Iran’s growing frustration, rather outlandish methods are also on the table. According to a secret report obtained by Western intelligence agencies, Iran may be considering creating a huge oil spill, which would block the Strait and force the West to temporarily suspend the sanctions during the clean-up. The sabotage plan – aptly given the codename “Murky Water” – would of course cause a large-scale environmental disaster, bringing to mind another historical parallel with Iraq: Saddam Hussein set many Kuwaiti oil wells on fire and dumped millions of gallons of oil into the Gulf in 1991 in a strategic move against invading US forces, thus crippling the fishing industry for years, and with widespread damage to flora and fauna.

Increasingly restrictive sanctions on Iran’s energy sector, and its threats to close the Strait, have significant implications for the global oil price as well. Ironically, up till now we have been relatively ”lucky”, because in parallel to the embargo, global oil demand has also been growing slowly due to the global economic slowdown. A potential complete halt of Iranian oil exports would of course affect the Iranian economy adversely, but is likely to also increase the global oil price because of supply security fears. Higher oil prices are beneficial to exporter countries, but they could further endanger weak Western economic growth. And the shock to world production (in terms of percentage) of closing the Strait of Hormuz could be threefold that of the 1973-74 OPEC oil embargo. The costs of maritime insurance and transportation would also skyrocket. Given the short term price insensitivity of oil demand and the lack of substantial spare capacity, even minor disruptions and outages can lead to spectacular price volatility.

Overall, the future of Iran’s nuclear ambitions and its willingness to give in to diplomatic pressure remain uncertain, as is the question of whether it will realize its threats of closing the Hormuz Strait. But given the size of Iran’s reserves and its role in global petroleum supply, any major development in its oil industry will have significant implications not just for the stability of Iran, but for global oil prices and the entire Middle Eastern region as well.

A bejegyzés trackback címe:

Kommentek:

A hozzászólások a vonatkozó jogszabályok értelmében felhasználói tartalomnak minősülnek, értük a szolgáltatás technikai üzemeltetője semmilyen felelősséget nem vállal, azokat nem ellenőrzi. Kifogás esetén forduljon a blog szerkesztőjéhez. Részletek a Felhasználási feltételekben és az adatvédelmi tájékoztatóban.