Showing typical zombie signs: far from well and alive, but not quite dead, and acting in an unpredictable way.

By István Zsoldos and Péter Simon Vargha

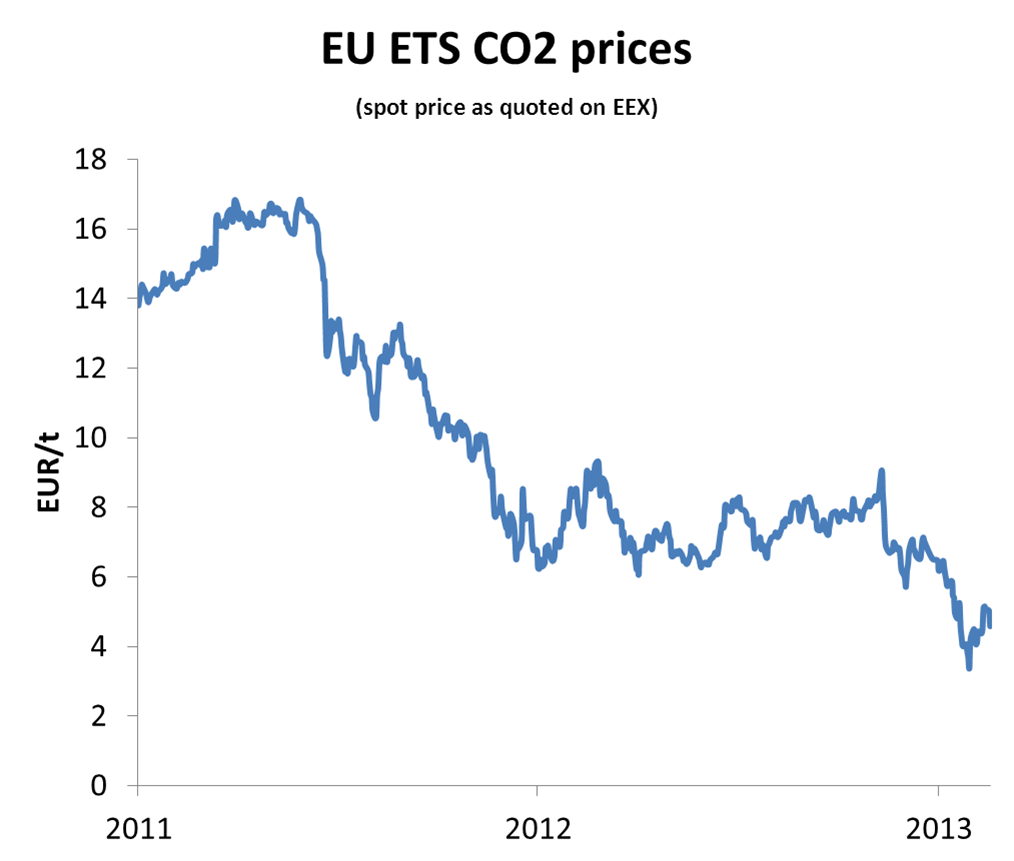

There are efforts to resurrect it. For example, the EP Environment committee has just backed a proposal to temporarily freeze some quota auctions, effectively postponing them (aka ‘backloading’). Speaking of unpredictable outcomes: despite the news of the committee backing the plan, CO2 allowances were down over 10% from around a very low 5 EUR/ton following the decision. This was due to the fact that the wording of the legislation is still debated and the proposal got through with a narrower margin than had been expected.

The proposal continues its way in the EU decision making labyrinth, and will either be adopted or not. Because there are many, who completely oppose touching the system in any way. Sooner or later it needs to be touched.

How is the ETS supposed to work?

The ETS is a cap-and trade system for energy-intensive industry sectors in the EU (which now covers around half of energy-related emissions). The policymakers limit how much CO2 emissions they allow, and somehow distribute among market participants the quotas that represent the allowed CO2 emissions (this could be either auctions or free allocation). Then, the market players buy and sell the quotas among themselves, until those who value them most (for whom emitting CO2 is worth the most) acquire them, leading to an efficient result and a market price of CO2.

(From our post in December. You can also read there why the system does not really work that way.)

Because the EU’ emission trading system is struggling. It is no longer a price indicator, but a political barometer – we wrote about it in detail here. If the fixed supply of something exceeds fixed demand*, the price should be zero. That is the case with the EU’s emission trading permits. There are much more emission allowances in the market than industry ‘demand’ to emit CO2. The reason why the price is not zero is that investors are expecting (and pricing in) some politically motivated action that would reduce supply or increase demand.

The decision today is no such thing – it is a redistribution of supply over time. The amount of the allowances that Commission removes now will be put back on the market in a few years’ time, so there will be no changes in the overall supply of quotas. Moreover, the intended amount of quotas removed (900 mn tons) is smaller than the current surplus on the market, which was estimated by the Commission to be a whole year’s worth of demand (2000 mn tons) Thus, the oversupply problem would not go away, not even temporarily. Therefore, in theory the redistribution should not affect the price much. But it is a signal that the EU is trying to do something to prevent the price going to zero.

They won't stay dead. Source: walterfilm.com

They won't stay dead. Source: walterfilm.com

Of course once the emission allowances are removed temporarily, the perceived status quo changes: these allowances will be out from the market. And the overall oversupply problem would be unchanged. So this naturally leads to speculations: is the Commission removing the allowances in two steps, first temporarily, and later making it final? Is this in fact a disguised structural measure?

CO2 prices in freefall. Source: Bloomberg

CO2 prices in freefall. Source: Bloomberg

The credibility of the system is already shaking, irrespective of whether this ‘backloading’ gets through or not. That is a serious problem because high uncertainty curbs investments into emission-reduction measures, too. We think the EU should move towards a carbon tax system, and forget about all the planned economy nonsense of separate renewable targets and energy and car efficiency and lots of other targets and regulations. That is unlikely to happen. Or the EU could come clean and admit that it does not believe in (or does not have the required political cohesion to operate) a price-based mechanism to reduce CO2, and give up the current quota system altogether. As the system stands now, this is just another layer of uncertainty for investors. A zombie that is not quite dead, and is acting in an unpredictable way.

* To be more precise: fixed supply exceeds the amount demanded at each positive price level

A bejegyzés trackback címe:

Kommentek:

A hozzászólások a vonatkozó jogszabályok értelmében felhasználói tartalomnak minősülnek, értük a szolgáltatás technikai üzemeltetője semmilyen felelősséget nem vállal, azokat nem ellenőrzi. Kifogás esetén forduljon a blog szerkesztőjéhez. Részletek a Felhasználási feltételekben és az adatvédelmi tájékoztatóban.