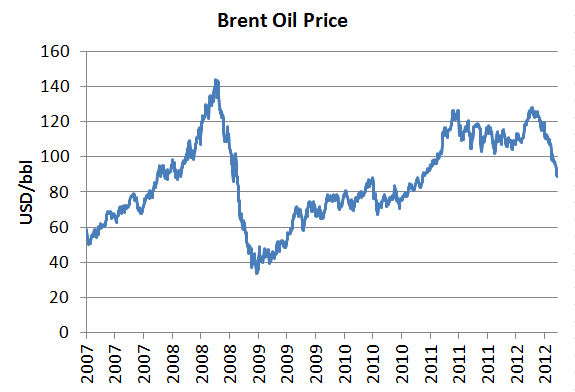

Oil prices are down 30% from recent highs (and could fall further). Those who say it’s time to celebrate simply miss the point: the cause has been slowing demand, in turn a result of a global macroeconomic slowdown. What they also miss is that at current prices, the world still pays twice as much on oil than in the decades before the crisis. That is largely due to a slow-motion supply shock, which does not seem to go away.

Source: EIA

No, it’s not the nasty ‘speculators’

Some say the recent oil price decline from around 120 USD/bbl to below 90 USD/bbl marks the end of a mania, similar to the dot-com bubble and now we can start to celebrate a coming long period of declining prices. Don’t believe them: there is no evidence whatsoever that the prices are determined by speculation (in the medium run, and for speculators the medium year is significantly shorter than one year).

‘Speculators’ do not lead, rather follow price movements. The US Commodity Futures Trading Commission tracks the open positions of non-commercial traders, these are the traders who do not use trading as hedging, often simply labeled ‘speculators'. Their net long positions (the amount of oil contracts they hold) are still above those at the start of the year, the last time when prices started to climb, and prices are now much lower. This means that they have actually lost big money on their trades: buying high and selling low is not a very good business proposition…

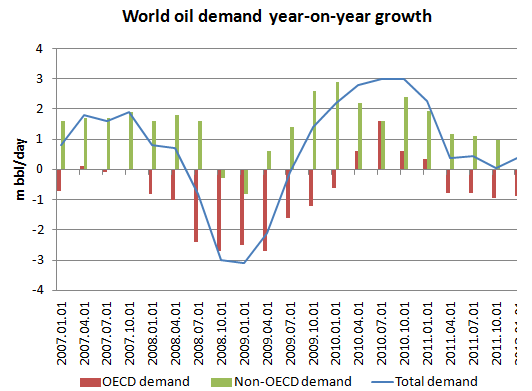

It is the global slowdown

The price decrease was simply due to a slowdown in global growth and consequently slowing oil demand. Because oil supply does not adjust easily in the short run, and oil demand’s response is also limited, (in economist lingo: supply and demand are price inelastic) small changes in quantities can have large impacts on prices. It needs a large price swing before some supply is withdrawn in case of a demand slowdown, and similarly, in case of supply disruption, demand only adjusts if there is a large price increase. There is no voodoo in that, or market mania, or speculation: it is just supply and demand.

Source: IEA

The demand has slowed because of the uncertainty surrounding the Eurozone crisis, and a slowdown in China and other emerging economies. I do not think there is much to celebrate about this. Of course, lower oil prices help a little, but they will not get the world economy growing again. The only scenario with a long period of much lower prices is one in which global growth is derailed for longer, with a hard landing (and staying on the floor) in China.

If there had been a decline in prices because of significantly and sustainably higher supply, I think that would be a much bigger achievement and cause for some celebrations. There are some bright spots: unconventional oil production has been on the rise in the US, but up till now it does not seem to reach the scale of such a global positive supply shock as in the case of natural gas.

Slow motion supply shock also at play

Despite these bright spots, from a longer term perspective supply has surprised to the downside: we have been in a slow motion supply shock (oil has become harder and much more costly to find and produce than, say, 15 years ago), while demand has been marching up (aside from cyclical blips, as the current one).

Oil prices have increased more than fivefold, from below 20 USD/bbl to around 100 USD/bbl in the past twelve years. This was a result of a combination of a demand shock (emerging country demand) and supply shock (slow production growth outside OPEC). For those who have thought the supply part did not play a role, here is a comparison I made of IEA World Energy Outlooks in retrospect, shedding some light on the issue.

Most oil exporters have also started to become addicted to the higher oil prices. They responded to the Arab spring not by starting to reform, but by spending more, in order to keep social tensions under control. And the addiction can lead to nasty withdrawal symptoms in case of a temporary oil price drop.

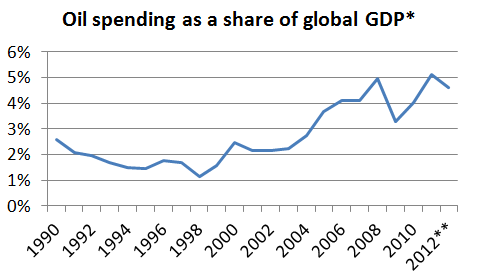

The world still spends a lot on oil

And it is not just exporters who are addicted. Even at the current 90 USD/bbl ‘lows’ the world pays more than 4% of its GDP on oil. Maybe this does not sound that much, but it is: it is around the same share as before the financial crisis struck, back in 2006-7, but without the mitigating effect of the economic boom back then. And this share is almost twice what the world paid in the two decades before that.

Source: BP, IMF, IEA, own calculations. *: Oil spending proxied by global oil consumption multiplied by Brent price (BP) **: assumes 90 USD/bbl for the rest of the year, a 102.5 USD/bbl annual average. Oil demand growth projection by IEA.

The supply shock also suggests that there are no quick fixes to this situation. The adjustment away from oil has started (see e.g. Cristof Rühl’s concluding remarks in his recent presentation of the BP World Energy Stats Review), but it requires time, technology changes and massive investments.

In the meantime, oil prices will remain volatile, with cheers every time there is a periodic decline, like the current one. But do not expect miracles.

A bejegyzés trackback címe:

Kommentek:

A hozzászólások a vonatkozó jogszabályok értelmében felhasználói tartalomnak minősülnek, értük a szolgáltatás technikai üzemeltetője semmilyen felelősséget nem vállal, azokat nem ellenőrzi. Kifogás esetén forduljon a blog szerkesztőjéhez. Részletek a Felhasználási feltételekben és az adatvédelmi tájékoztatóban.