Introducing carbon taxes instead of the currently struggling European cap-and-trade (ETS) system would be a good idea. Let’s hope the Italians mean it, and that this enthusiasm will survive the upcoming elections.

Italy’s environment minister, Corrado Clini recently said he would propose a carbon tax instead of the current Emissions Trading System at the December Council meeting of EU environment ministers. It is strange that this proposal has hardly made it to the international news: only a few news services reported it (like Reuters Point Carbon , subscription required, or Climate Policy Watcher).

We like carbon taxes, because taxes are more predictable than ever-fluctuating prices in a cap-and-trade system, and can reduce emissions cheaper and more effectively. To put it simply: what businesses want is to put a concrete number in their spreadsheet models – and a previously announced carbon tax is such a thing. So we agree with the conclusion of Corrado Clini that it would help investment decisions (and by the way closure decisions). But most business lobbies think that the EU has invested so much political capital into the ETS, so that proposing a complete overhaul would be impossible. Maybe if carbon taxes are put back on the table by Italy, it will have wider support.

Mario Monti and Corrado Clini. Source: ilsussidiario.net

Mario Monti and Corrado Clini. Source: ilsussidiario.net

How is the ETS supposed to work and what has been wrong with it? The ETS is a cap-and trade system for energy-intensive industry sectors in the EU (which now covers around half of energy-related emissions). The policymakers limit how much CO2 emissions they allow, and somehow distribute among market participants the quotas that represent the allowed CO2 emissions (this could be either auctions or free allocation). Then, the market players buy and sell the quotas among themselves, until those who value them most (for whom emitting CO2 is worth the most) acquire them, leading to an efficient result and a market price of CO2.

The problem with the system is that politicians were skeptical about it from the start. Markets sound good and do the job, but politicians do not really trust them to deliver the exact tangible results they would like. The market may solve the problem by say switching from burning coal to gas in already existing plants, but there is little opportunity for a politician to claim credit for that and to appear in the evening news opening new facilities. So they also introduced some other targets, for renewables and energy efficiency (the other 20-20 targets). These also bring massive emissions reductions, but usually at way higher costs. A much better way would be to incentivize research and development in renewables, which could bring the costs of these technologies down, but I am digressing.

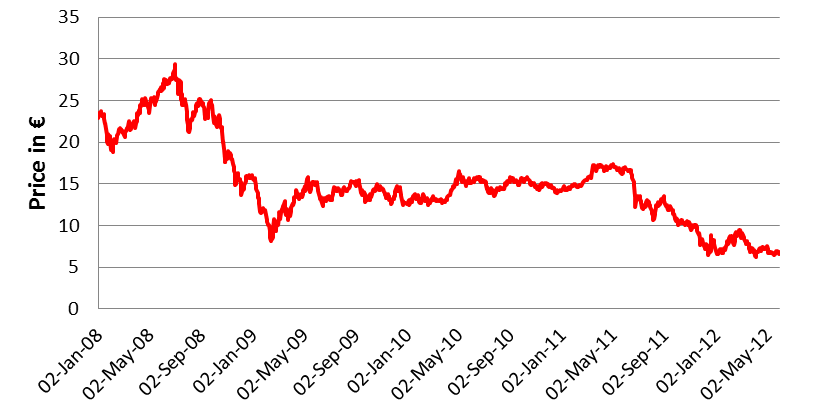

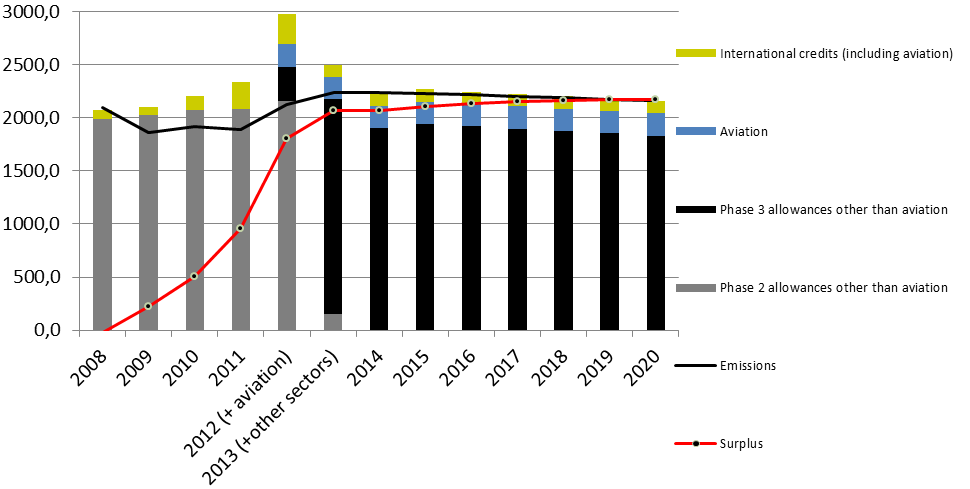

Moreover, the recession in the EU cut the demand for energy and hence also emissions. The energy efficiency and renewables targets, together with the recession have created a glut of quotas: there are much more allowances out there than there is demand to emit CO2. The Commission has recently estimated the surplus to equal a whole year of ETS emissions! So prices have collapsed.

EU Carbon prices have collapsed. (EUR/ton). Source: European Commission

EU Carbon prices have collapsed. (EUR/ton). Source: European Commission

Why is a price collapse bad? Basically, because now there is no further incentive to use low-emission technologies. It is worth burning coal instead of gas. This has led some politicians to say, well you see, we‘ve been saying the ETS would not work, and voila it does not work. There are now efforts to try and repair the system by ad-hoc measures: postponing quota allocations or removing some altogether from the market.

Surplus near a year of emissions. Supply&demand of quotas (mn ton) Source: European Commission

Surplus near a year of emissions. Supply&demand of quotas (mn ton) Source: European Commission

However, many countries in Europe are in a deepening recession and the last thing they want is an increase in energy prices. And by construction, an increase in the price of CO2 results in higher electricity costs. (The worse financial conditions are in a way beneficial, because it makes many countries think twice whether to push extremely costly renewables any further.) But the financial crisis has also resulted in a stalemate: there is hardly a chance to genuinely repair the system. Coal-dependent Poland has been the loudest country opposing any changes to the ETS. This is, however, a rather comfortable situation for many other countries: they have a maverick, Poland, which does the dirty work instead of them. (And do not be mistaken, it is not just Poland, which burns an awful lot of coal. EU burned 12% more coal and lignite recently than two years ago, according to Eurostat data.)

My guess would have been that Italy, with its already sky-high electricity prices would be in the camp that opposes any further measures. But it seems this is not the case. What made Italy a friend of carbon tax? Probably two things: first, subsidizing existing renewables has already become quite a big burden. So now Italy is struggling to find sources to pay for that. Carbon taxes would be a good option. (Of course it would be even better if they could spend already pledged renewable subsidies elsewhere, more efficiently, but that’s not an option. At least when you think the rule of law is important enough so that you do not retroactively and unilaterally change the renewables subsidy schemes.)

The second important factor is that the Monti government now has the guts to change the policy stance to a more rational one, and take on fights at EU levels as well. This rationality has been evident in a number of energy issues as well. For example, insisting on ENI selling its natural gas pipeline business, so that the gas market becomes a functioning market. (In October, ENI sold a 30% stake in Snam, the pipeline operator, and now owns less than 25%.)

Whether these policies (and a bunch of other general reform measures which could make or break Italy) last after next year’s general elections is another question. We wish them good luck.

A bejegyzés trackback címe:

Kommentek:

A hozzászólások a vonatkozó jogszabályok értelmében felhasználói tartalomnak minősülnek, értük a szolgáltatás technikai üzemeltetője semmilyen felelősséget nem vállal, azokat nem ellenőrzi. Kifogás esetén forduljon a blog szerkesztőjéhez. Részletek a Felhasználási feltételekben és az adatvédelmi tájékoztatóban.